Change my payee information

Here's how to make changes to your payee information, including your bank record info, preferred payment method and preferred tax form.

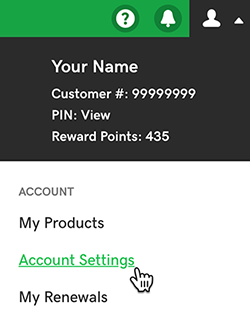

- Log in to your ITEGY account.

- Click this icon in the upper-right corner:

- Click Account Settings.

- Verify that your contact information is accurate. If necessary, click Edit to make changes and then click Save when you're done.

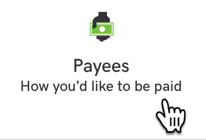

- Click Payees (you might need to scroll down a bit).

- Next to the Payee account you want to edit, click View/Edit.

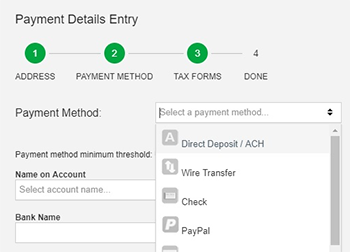

- In the Payment Details Entry page, click Edit to make changes. When you're done here, click Next.

- From the Payment Method list, select a payment method and then enter your banking information. When you're done, click Next.

Note: You get paid when the balance due reaches the minimum threshold amount. There may be a transaction fee for each payment.

- Select a tax form from the list, complete the information as needed, and then click Next. You're all done!

More info

- We'll send an email notification for account activities, like updates to your payee info or tax form status.

- If you need help determining which payment method is right for you, we recommend talking to a business or tax lawyer.

- For information on payee accounts, see Setting up Payee Accounts.